Homeowners and potential buyers are eagerly awaiting the Federal Reserve’s September 2024 meeting, hoping for insights that will influence mortgage rates. This decision directly impacts the housing market, and with rates fluctuating over the past year, the question of whether to refinance is on everyone’s mind. Understanding the implications of the Fed’s move is crucial for making informed financial decisions.

Mortgage Trends to Watch: Expert Analysis and Insights

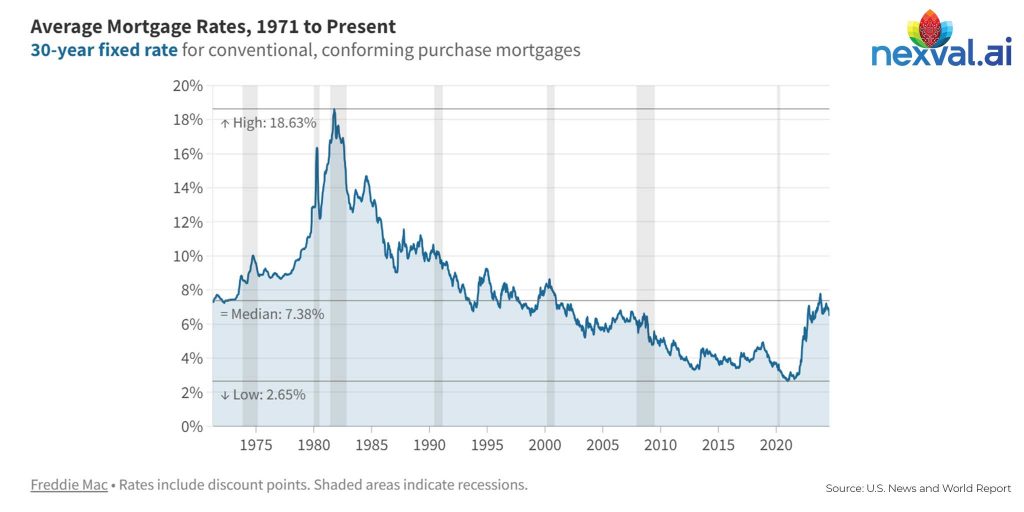

Over the past year, mortgage rates have seen a significant decline, dropping from a peak of 7.79% in October 2023 to around 6.25% in August 2024. This decrease is attributed to factors like cooling inflation (down from 3.2% to 2.9%) and rising unemployment (from 3.8% to 4.3%). This shift benefits potential homebuyers with lower borrowing costs and increased purchasing power.

What does this Fed Meeting mean for Mortgage Lenders?

Interest Rate Cuts: The Fed is expected to reduce rates by 0.25 to 0.50 basis points, impacting mortgage lenders in a few ways:- The impact on mortgage rates might be limited as the market anticipates the cut.

- Lower rates could lead to increased prepayments, reducing servicing fees for lenders.

- Other economic indicators, like rising unemployment, suggest further rate cuts in the coming months.

Considering Different Scenarios: The Fed’s decision could have varying effects:

- Rate Hike: This could make refinancing less attractive and potentially increase monthly payments for those with adjustable-rate mortgages (ARMs). The housing market might also slow down due to higher borrowing costs.

- Rate Hold: Mortgage rates might remain stable, offering a window to refinance before potential future hikes. This stability could also boost consumer confidence in the housing market.

- Rate Cut: This scenario would likely lead to lower rates, making refinancing highly attractive with potentially lower monthly payments and reduced interest costs. It could also stimulate the housing market by making homeownership more affordable.

Beyond immediate rate changes, homeowners should consider long-term financial goals when deciding to refinance. Factors like the length of time they plan to stay in their home, overall financial health, and future market conditions should be considered.

Unlocking Mortgage Insights with Nexval.ai: Your AI-Powered Guide to Smarter Refinancing

The Federal Reserve’s meeting and the resulting actions can significantly impact mortgage rates. While the immediate effects might be short-lived, homeowners should carefully evaluate their circumstances before making a decision. Consider consulting a financial professional to determine if refinancing aligns with your long-term financial goals.Nexval.ai harnesses cutting-edge AI to analyze vast amounts of market data and forecast potential shifts in mortgage rates. By evaluating key factors like inflation trends, employment rates, and historical Federal Reserve actions, Nexval.ai offers homeowners data-driven insights to make informed refinancing choices.Visit Nexval.ai today to explore how our AI-driven insights can help you achieve your financial goals.

About the Author:

Leveraging 20+ years of experience and a MBA (Banking), PPD leads Nexval.ai’s Mortgage Services with a passion for AI-powered innovation and RPA efficiency.