As a mortgage technologist who has spent over 3 decades working with technology and data in the mortgage industry, I’m always looking for ways to improve processes and drive better outcomes for lenders. One of the most exciting developments I’ve seen lately is the application of Gradient Boosting Machines (GBM) in credit scoring. This AI-powered tool is changing how we assess borrower risk, and it’s something I believe every lender should be considering to stay competitive.

What Makes Gradient Boosting Machines So Powerful?

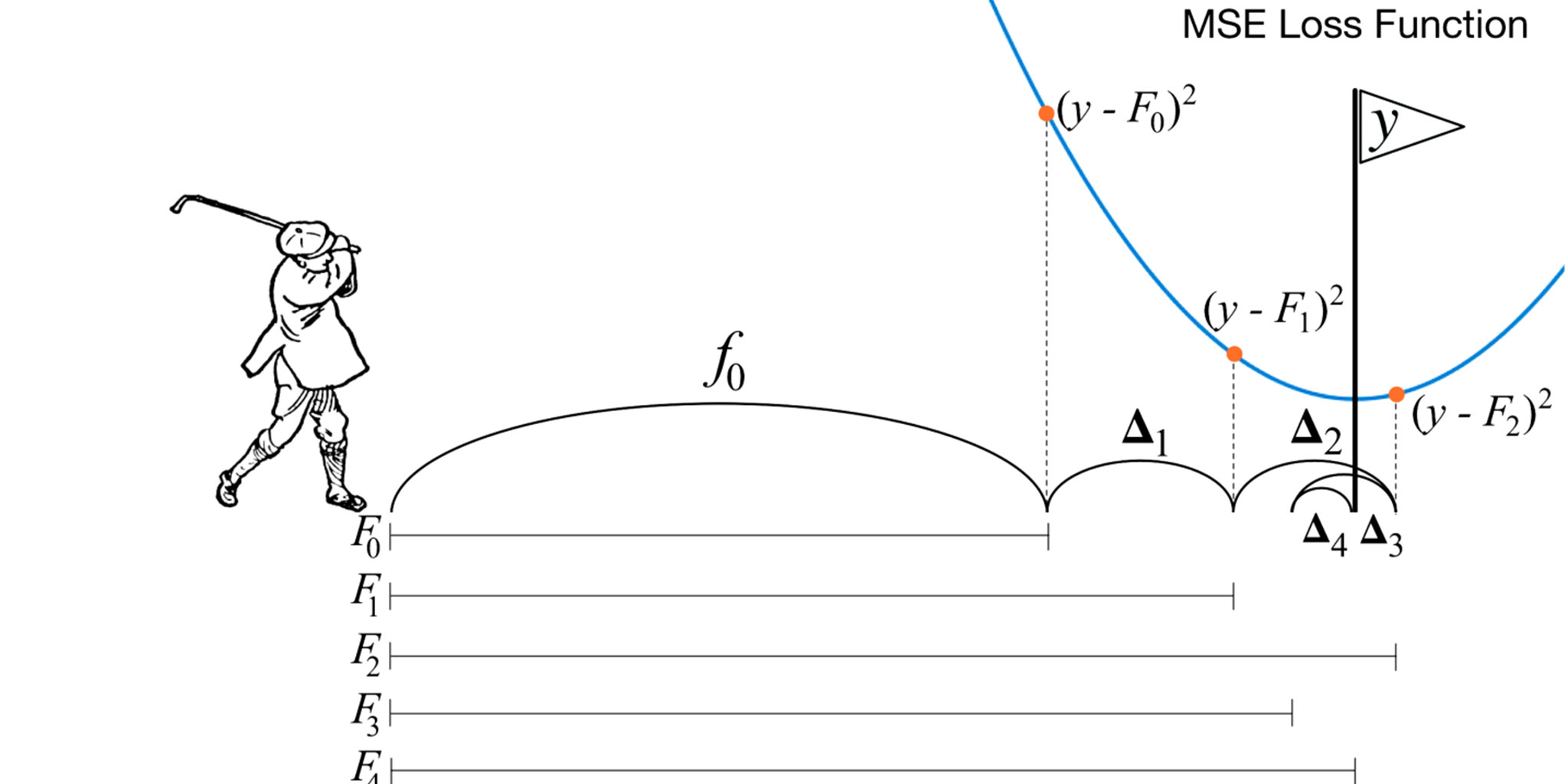

GBMs are a form of machine learning that builds multiple decision trees in sequence, with each new tree correcting the mistakes of the one before it. This allows the model to get progressively more accurate over time. For credit scoring, this means a GBM can handle the complexities of borrower behavior far better than traditional models.

The beauty of GBMs lies in their ability to incorporate alternative data into their predictions. Instead of just relying on a FICO score or basic debt-to-income ratio, GBMs can factor in things like rent payment history, utility bills, and even job stability. This results in a more complete picture of the borrower’s financial health, allowing lenders to make smarter decisions.

How AI-Driven Credit Scoring Impacts Lenders

For mortgage lenders, especially those who are originating non-traditional loans, balancing loan approvals with risk management is always a challenge. GBMs help by reducing false positives (approving risky borrowers) and false negatives (denying good borrowers), which directly improves both loan volumes and default rates. The precision of these models means fewer defaults and more approvals of creditworthy borrowers, which is key to profitability.

Additionally, GBMs scale well. As your portfolio grows, the model continues to learn and adapt to new data. This means the more you use it, the better and faster it becomes at making predictions—something traditional models just can’t do.

Steps to Developing a GBM-Based Credit Scoring Model for Mortgage Lenders

To develop a GBM-based credit scoring model, a mortgage lender would begin by gathering extensive data from both traditional and alternative sources. This could include borrower information such as credit scores, income levels, debt-to-income ratios, and loan history, as well as non-traditional data like rent payment records, utility bills, and employment stability. The lender would then split this data into a training dataset and a test dataset.

A machine learning team would train the GBM model on the training dataset, allowing the model to learn how different features (e.g., late payments, income trends) contribute to credit risk. During this process, the GBM would build multiple decision trees, each correcting the mistakes of the previous one to improve accuracy. Once trained, the model would be evaluated using the test dataset to ensure it can predict borrower risk accurately.

The final step involves integrating the GBM model into the lender’s existing loan origination systems, allowing it to make real-time credit scoring decisions. Continuous monitoring and updating of the model would be essential to keep it accurate as market conditions and borrower behavior evolve.

A Smarter Way to Optimize Credit Scoring

I’m a firm believer that technology should only be introduced in a process when the competitive advantage it provides is many multiples of benefit over traditional methods. GBM’s (built on the unique and proprietary loan data of the lender) can be used as an overlay over traditional scoring models to give the lender a unique competitive edge over other lenders who are all using off the shelf models based on publicly available data points.

While several companies can help you do AI development, Nexval stands out because of our deep industry knowledge and ability to deliver solutions tailored to your specific needs. Our expertise in mortgage outsourcing and real estate tech gives us a unique advantage in ensuring that you not only adopt this technology but also obtain immediate quantifiable benefits to your bottom line.

If you are tired of the AI hype cycle and are at a loss how to use this technology in real life use cases such as GBM based credit scoring, let’s have a conversation.