Sampling has long been a cornerstone of mortgage origination loan audits. Whether it’s assessing compliance, monitoring loan quality, or identifying fraud, sampling has offered a practical way to audit without drowning in data.

But what if we didn’t need to sample anymore?

The mortgage industry is reaching a critical inflection point. With artificial intelligence (AI) and unlimited computational resources, we’re moving toward a future where every single loan can be audited in real time. This is a transformative shift, especially in an industry where even one mistake can have devastating consequences.

Why Sampling Has Been the Norm

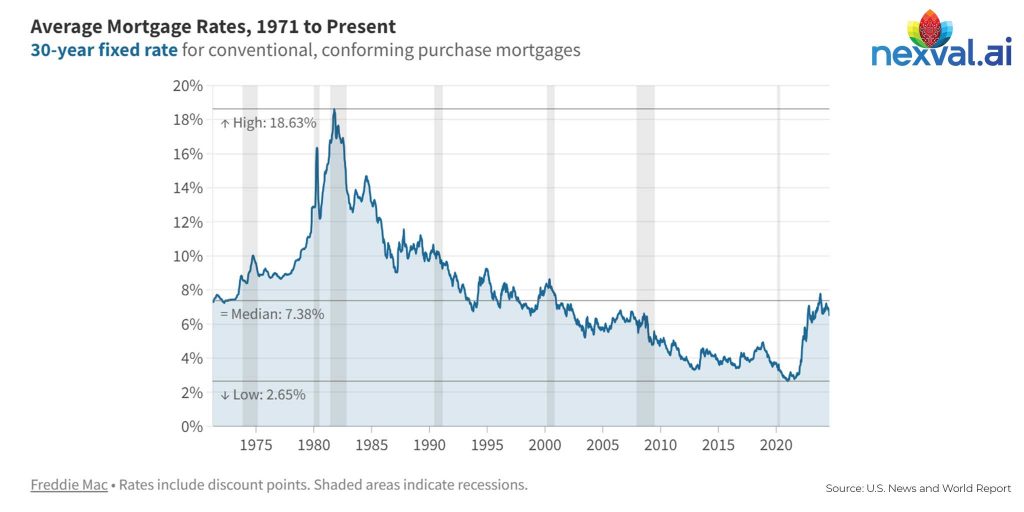

Sampling in mortgage lending has traditionally been a necessity born of resource limitations. Conducting a thorough review of every loan file in a portfolio is both time-intensive and prohibitively expensive. Imagine the cost of hiring two sets of underwriters—one to underwrite loans and a second to re-underwrite the entire process for quality control. This would effectively mean performing a 100% re-underwrite, an approach that’s simply unfeasible in an industry already grappling with razor-thin margins and the volatility of interest rate-driven market cycles. Instead, lenders rely on sampling, examining a subset of loans to draw statistically valid conclusions about the quality and compliance of their overall portfolio. While practical, this approach inherently leaves gaps and risks undetected errors that can prove costly.

The Cost of a Single Mistake

In other industries, especially those producing high volume and low cost products or services, a reasonable amount of sampling errors might be just inconvenient; in mortgage banking however, they can be catastrophic. Consider a few of the potential consequences of an undetected error in a single originated loan:

• Loan Buybacks: A single non-compliant loan could result in a costly repurchase demand from investors.

• Regulatory Penalties: Undiscovered compliance gaps could lead to fines from the investor or Mortgage Insurance provide

• Reputational Damage: Errors in critical areas like a fair lending violation can lead to public scrutiny, loss of customer trust, and long-term harm to the lender’s brand and credibility.

These risks underscore a painful truth: sampling leaves too much to chance and possibly threatens the long-term viability of the mortgage company.

Enter AI: Auditing Every Loan, Every Time

Artificial intelligence eliminates guesswork by empowering lenders to audit every loan file in its entirety, overcoming the challenges posed by fragmented data. Mortgage loan data typically resides across disparate systems—Loan Origination Systems (LOS), Appraisal platforms, Title systems, and more—and is often locked within scanned documents or static images. Traditionally, human auditors had to manually gather and transcribe these data points for quality control, a labor-intensive and time-consuming process.

Today, advanced AI systems can seamlessly analyze data from source documents, screen captures of core systems, or API integrations with these platforms. By doing so, AI enables a comprehensive audit of 100% of loan files, identifying errors, compliance gaps, and potential risks with unprecedented speed and accuracy—transforming a task that once required countless human hours into an efficient, automated process.

Further, AI audit systems surpass human auditors in its ability to continuously learn and improve. Unlike humans, who require years of experience to develop expertise, AI systems are trained on vast datasets encompassing past audits, diverse scenarios, and even errors made during prior reviews. This iterative learning process enables AI to refine its accuracy and adaptability with each audit cycle. As it encounters new patterns or anomalies, it integrates these insights into its algorithms, ensuring that similar issues are identified more effectively in the future. This eliminates the reliance on individual human expertise, developed over a long time – one human at a time, and instead offers a scalable, ever-improving solution that ensures consistent quality and precision—no matter how complex or varied the audit requirements.

Here’s how AI is reshaping mortgage loan audits:

• Real-Time Analysis: AI can review entire loan portfolios in minutes, flagging discrepancies as soon as they arise.

• Precision: Machine learning models can detect subtle patterns—such as mismatched income data or anomalies in credit reports—that humans might overlook.

• Consistency: AI applies the same rules uniformly, ensuring no file slips through the cracks.

For mortgage lenders, this means fewer costly mistakes and greater confidence in their portfolios.

Beyond Avoiding Errors: Unlocking Strategic Value

While AI transforms the audit process, human expertise remains vital. Mortgage lending is complex, and not every anomaly flagged by AI requires action. Further, as I noted in a previous article, Six Hidden Risks of using AI in Mortgage Compliance, AI systems are prone to unexplained “hallucination” errors. Humans can counter these shortcomings by bringing into the process the context, judgment, and decision-making needed to ensure fair outcomes.

In this new paradigm, human auditors focus on:

• Validating Findings: Ensuring AI-flagged errors are genuine and actionable.

• Enhancing AI Models: Continuously training systems to adapt to new risks and regulations.

• Providing Insight: Understanding nuances AI might miss, such as borrower-specific circumstances.

This “human-in-the-middle” approach combines the scale and speed of AI with the insight of experienced professionals.

Beyond Avoiding Errors: Unlocking Strategic Value

Auditing every loan, every time, doesn’t just reduce errors—it creates opportunities for improvement. Lenders gain granular insights into their operations, allowing them to:

• Identify systemic issues and resolve them at the root.

• Refine underwriting guidelines to improve efficiency and accuracy.

• Reduce costly buybacks and investor disputes.

• Proactively address compliance risks in real time before they escalate.

Veritiq: Your Partner in AI-Driven Audits

At Veritiq, we understand the stakes. That’s why we’ve developed an AI-based real-time, full-frame audit system designed specifically for mortgage lenders. With our solution, you can move beyond sampling to audit every loan in your portfolio with precision and confidence.

Whether you’re looking to reduce costly loan buybacks, improve compliance, or enhance operational efficiency, Veritiq’s cutting-edge technology and human-centered approach ensure you’re always one step ahead.

Are you ready to embrace the future of mortgage loan quality? Let’s discuss how Veritiq can help.