Capitalize on AI

To Streamline and Simplify

Data Workflows

Real use cases

The best ideas come from the people

closest to the business

Document Analysis Automation

Automate Document Extraction, Classification, Validation by the usage of multi layered and multi mix model for validation

Legal and Compliance Regulations

Automate generation of concise and summaries of complex legal, anomaly detection, easy conversion

Property Valuation Modelling

Accurately valuing properties for mortgage appraisal by AI statistical models, multi layered analysis

Automating Title Search and Curing with AI

Automate with AI models trained on vast datasets of public records and title documents, automating significant portion of title search and flag for human review

Closing Processes with AI-driven DMS

Automate with AI Model to automate document management, extraction, manage document workflows and automated reminders

Predictive Modelling in Title Insurance Claim

Optimize and analyse by AI Model on Claim Pattern towards mitigating risks and improve reserves

Title Roadmap Automation

Streamline workflows, automating tasks, sub processes, integration for Title workflow

Title Search to Funding Audit with Nexval.ai

Services

Proven 20-year track record

AI-powered staff augmentation: Servicing expertise meets machine learning

Staff Augmentation:

End to End Title Roadmap Experts – Order Entry, Title Commitment, Title Search, Examination, Abstract Services, Curative, Tax Search, Closing, Closing Disclosure, Post Closing, Funding Audit, Policy Production, AI/ML or Any DevOps Support personnel.

Complimentary Beta Partnership -

contact info@nexval.ai for more details

Mortgage Document Classification

Automate Document Classification, Extraction by NLP Models for efficient processing and routing

Customer Segmentation

Clustering automation to group targeted borrowers towards personalized CX and risk mitigation

Property Valuation Modelling

Accurately valuing properties for mortgage servicing and default management by AI statistical models, multi layered analysis

AI enabled Automated Loss Mitigation Solutions

Streamline workflows, automating tasks, sub processes, integration for faster intervention and Borrower outreach

AI enabled Automated Default Solutions

Streamline workflows, automating tasks, sub processes, integration for faster intervention and Borrower outreach

Predictive Modelling in Loss Mitigation

Optimizing loss mitigation efforts by strategizing plans for Modification or forbearance, multi layered validation

Servicing Roadmap Automation

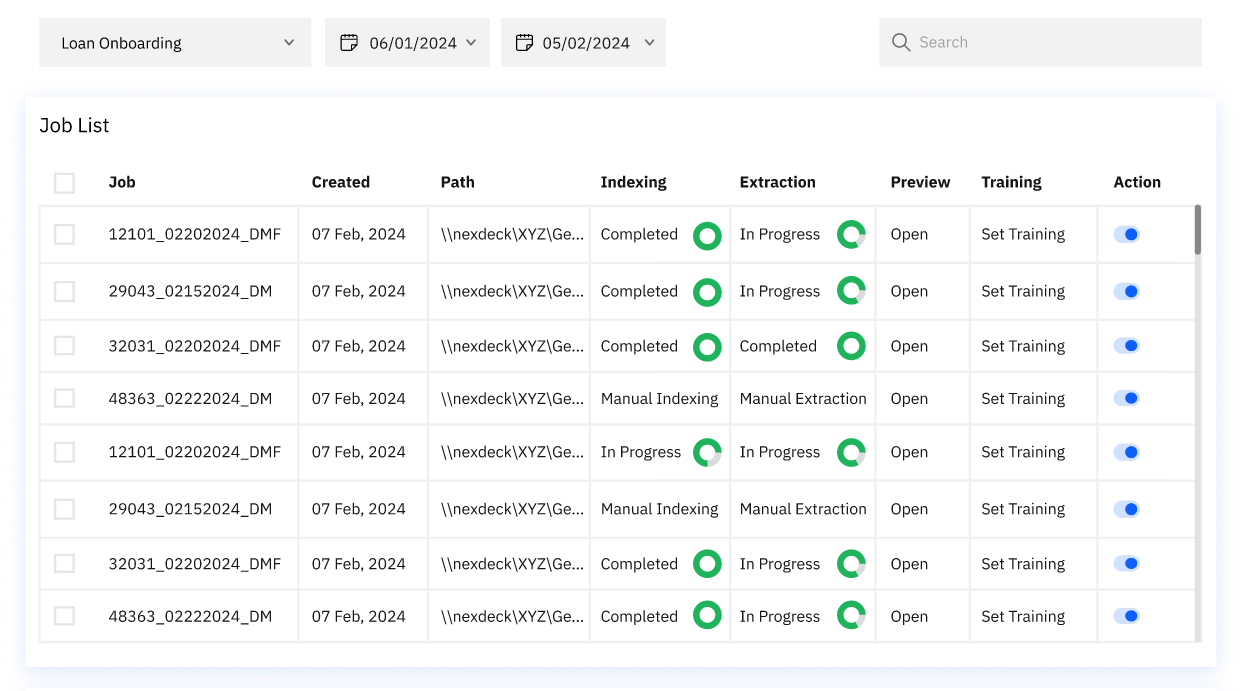

Streamline workflows, automating tasks, sub processes, integration for Loan Boarding, Escrow, Payoff with Nexval.ai

Services

Proven 20-year track record

AI-powered staff augmentation: Servicing expertise meets machine learning

Staff Augmentation:

End to End Servicing Roadmap Experts – Loan Boarding, Loss Mitigation, Foreclosure, Bankruptcy, REO, Default Underwriting, Credit Risk, Investor Relations, amongst others.

Cost and Efficiency, Competitiveness boosted by AI, AI/ML or Any DevOps Support personnel.

Complimentary Beta Partnership -

contact info@nexval.ai for more details

Property Preservation Maintenance Audits

Automates property preservation image audits (before, during, after) with computer vision, generating customized reports for streamlined workflows

Property Feature Detection

Automate auto detection of objects exterior / interior with computer vision and neural network assisting Image classification

Property Valuation Modelling

Accurate inputs by the Model to provide insights as a upstream to the valuation process

REO RoadMap Automation

Streamline workflows, automating tasks, sub processes, integration for REO workflow

Services

Proven 20-year track record

AI-powered staff augmentation:

REO expertise meets machine learning

Staff Augmentation:

End to End REO Roadmap Audit Experts – Property Preservation Audits, Claims Handling, Pre-Post Foreclosure Services, Eviction Management, Valuation, Title & REO Closing Services, All Maintenance per Regulations, AI/ML or any DevOps Support personnel, Transparency (XAR) and Bias free rigorous trained models.

Complimentary Beta Partnership -

contact info@nexval.ai for more details

Accurate Forecasting & Decisioning

Uncover hidden patterns, optimize risk assessment, and unlock superior loan portfolio performance with Nexval.ai

Pre-Approval

Accelerate pre-approvals with AI-driven multi-validation. Enforce lender-specific guidelines seamlessly for faster, more accurate decisions

Disclosure Workflow

Automate the initial disclosure process – ensuring lender-specific compliance risk control – replicate lender workflow

AI Driven Credit Decisioning

Aid the Underwriters with credit scores and automated decision tree, multi validation

Service Providers

Automate the workflow management of Service Providers, follow ups, validation / exception reporting for Order Management and execution

Compliance

Automate the change management workflow for compliance refinements and auto updates

Customized Workflow Automation

Automate the Closing, Post Closing, Lock Desk and other workflows and perfect coalition between all teams at par with the lender’s workflow with Nexval.ai

Services

Proven 20-year track record

AI-powered staff augmentation: Origination expertise meets machine learning

Staff Augmentation:

20 to 5 years Experienced / Mid-Level End to End Origination experts AI/ML or Any DevOps Support personnel.

Complimentary Beta Partnership -

contact info@nexval.ai for more details

Threat Detection

Property Preservation Maintenance Audits

Automate Threat Detection across Enterprise –

Conduct ongoing threat intelligence analysis

Strengthen cyber defences, AI automating typical workflow -Neural Network

Supervised & unsupervised learning models – Unbiased training, detection analysis

AI - Managed Services Enhancements

Property Feature Detection

Predictive Asset Performance – AI run Mean Time Between Failures (MTBF), Mean Time To Repair (MTTR), cost savings

Accelerated IT Incident Resolution – AI run Mean Time to Detect (MTTD), Mean Time to Acknowledge (MTTA), Mean Time to Resolve (MTTR)

Intelligent IT Capacity Planning – AI run Resource utilization, cost per unit, infrastructure efficiency

Agile IT Support – AI run Ticket resolution time, customer satisfaction, first contact resolution rate

IT Services & DevOps

Proven 20-year track record

Staff Augmentation & Managed Projects:

AI You Can Trust: Nexval.ai

Designed with SOC 2 Security Standards

The journey of a

mortgage company

The Impact of

AI on Your Mortgage Operations

1101 Brickell Avenue

South Tower, 8th Floor

Miami, FL 33131

P: +1-786-206-9056

F: + 1-888-462-4923

E: info@nexval.ai

W: www.nexval.ai

I’m excited to guide industry colleagues through the current transformation. My goal is to offer valuable insights that benefit you and foster fruitful collaborations and partnerships.

Let’s embark on this journey together and unlock new opportunities in our industry! – Souren Sarkar

1101 Brickell Avenue

South Tower, 8th Floor

Miami, FL 33131

P: +1-786-206-9056

F: + 1-888-462-4923

E: info@nexval.ai

W: www.nexval.ai

I’m excited to guide industry colleagues through the current transformation. My goal is to offer valuable insights that benefit you and foster fruitful collaborations and partnerships.

Let’s embark on this journey together and unlock new opportunities in our industry! – Souren Sarkar

© 2025 Nexval | Terms

© 2025 Nexval | Privacy Policy | Terms